Self-Employed Mortgage in Calgary, AB

We help business owners in Calgary get approved for self-employed mortgages — even when banks say no.

- Focused on Self-Employed Mortgages

- Big Banks, Credit Unions & Other Lenders

- Serving Calgary & surrounding areas

Self-Employed Mortgages In Calgary

Calgary is home to over ~100,000 self-employed business owners, many have the dream of owning a home or are in need mortgage financing.

Unfortunately, lenders often decline business owners for a mortgage because their self-employed income doesn’t fit standard lending guidelines.

This leaves many business owners feeling stuck, unsure if they’ll ever be approved, or waiting years on the sidelines before they are able to qualify.

That’s where working with a mortgage specialist who understands self-employed mortgages can make all the difference.

Owen Langis with Mortgage Connection is focused on self-employed mortgages, helping business owners in Calgary get their mortgage applications approved.

By working with big banks, credit unions, and other lenders, our focus is always on one goal — finding the right solution to get your self-employed mortgage application approved.

💡 Did you know?

Calgary business owners can purchase a home with as little as a 5% downpayment?

Why Getting a Mortgage Is Different When You’re Self-Employed

Self-employed business owners in Calgary often run into a variety challenges when applying for a mortgage.

Tax write-offs, lower claimed or inconsistent income, being a newer business or past credit challenges can all make it harder to get your mortgage application approved.

Once declined by their bank, often times business owners do not seek out a second opinion on their mortgage options and can spend years waiting on the sidelines, missing out on homeownership or better financing options, putting their plans are put on hold.

We understand these challenges and can help you find the right lender & self-employed mortgage program to get your application back on track and moving in the right direction.

Why Self-Employed Borrowers Get Declined by their Banks

Self Employed – Less Than Two Years

New to being self-employed?

Many lenders want to see two full years in business before approving you for a mortgage.

Lower Taxable Income Due to Write-Offs

Business owners in Calgary often use tax write-offs to reduce their taxable income — which is great at tax time, but can make qualifying for a mortgage trickier.

Inconsistent Income

Self-employed income isn’t always the same month to month. Whether your business has busy seasons, slower periods, or fluctuating contracts, inconsistant income can affect your mortgage options.

Lower Credit Score

Business owners in Calgary sometimes have lower credit scores due to business expenses, fluctuating income, or relying on credit to manage cash flow. A lower score can affect your mortgage options.

High Debt Load

Often times business owners in Calgary carry higher debt from operating their business — things like credit cards, lines of credit, or equipment loans. While this is totally normal, it can impact how much you qualify for.

Limited Access to the Right Mortgage Programs

Many self-employed business owners have limited access to the right mortgage programs because their bank typically offers limited self-employed mortgage options and can review your income in just one way.

Do you have questions?

Let’s chat.

Why Calgary Business Owners Work With Us

We Specialize in Self-Employed Mortgages

Business owners choose us because we have a passion and focus on self-employed mortgages.

We understand write-offs, variable income, and specialized self-employed mortgage programs — we know how to present your file so lenders say yes.

Approval Options Beyond Traditional Banks

Many business owners get declined at big banks for a range of reasons.

We work directly with big banks, credit unions and other mortgage lenders who specialize in self-employed income, alternative documentation, stated income programs, and flexible qualification rules tailored for entrepreneurs.

Fast, Stress-Free Mortgage Approvals

Business owners don’t have time for slow approvals.

We streamline the entire process with simple document lists, quick communication, and lender relationships designed to get your mortgage approved faster.

Mortgage Solutions Built Around Your Business

Every business is unique — your mortgage should be too.

We build custom mortgage strategies around your cash flow, tax structure, business expenses, and long-term financial goals.

Expert Guidance on Income, Write-Offs & Tax Strategy

Self-employed income can be tricky. We help you understand how your tax returns, corporate structure, and deductions impact your approval — and show you the best path to a stronger mortgage file.

Better Rates & Terms for Business Owners

Because we specialize in self-employed borrowers, we know which lenders offer the best rates, flexible terms, and approvals for business owners.

You get options you won’t find on your own at the bank.

💡 Did you know?

Did you know self-employed business owners can get great mortgae rates, just like salaried employees.

Self-Employed Mortgage Programs

Many Calgary business owners don’t realize there are many specialized mortgage programs available which are designed to help self-employed borrowers get their mortgage applications approved.

These flexible mortgage options aren’t widely advertised and are not offered by every lender, so they often go unnoticed.

Most entrepreneurs only discover these programs are available after working with a mortgage professional who understands self-employed mortgages and knows where to find the right solutions.

Mortgage Solutions for Business Owners in Calgary

Less Than Two Years Self-Employed Mortgages

Even if you’ve been self-employed for less than two years, you may still qualify for a mortgage. Some lenders offer flexible programs for newer business owners, especially if you have strong industry experience or stable income with as little at 5% downpayment.

Learn More >>

Gross-Up & Add-Back

Self-employed borrowers can often qualify for a larger mortgage amount by using income “gross-ups” and allowable add-backs from their tax returns. These adjustments help reflect your true earning power by adding back certain business expenses.

Learn More >>

Stated Income (Insured)

We work with lenders offering Business-for-Self insured programs that allow self-employed borrowers to qualify with simplified income verification, strong credit, and a reasonable estimate of business income with as little as 10% downpayment.

Learn More >>

Bank Statement Mortgage Programs

Our bank statement mortgage options use 6–12 months of business bank statements to verify real business cash flow.

This is ideal for business owners with strong deposits but low net income showing on their personal tax returns due to tax write-offs who also have a minimum of 20% downpayment.

Learn More >>

Net Worth

A net-worth mortgage program is a great option for self-employed clients whose reported income doesn’t reflect their true financial strength. Instead of focusing on tax returns, lenders consider your assets, RRSP, TFSA, Stocks, Bonds, savings, and proceeds from sale of property to help you qualify. If you have a moderate net worth and a solid financial foundation, this program can make getting approved simpler and more flexible.

Learn More >>

Alternative Programs

“B” mortgage programs can be a fantastic option for self-employed clients because they look at your situation more flexibly than traditional banks. Often times these programs are offered by “AAA” lenders, allow higher debt-service ratios, consider alternative income documentation, and are comfortable with lower credit scores — This often means you can qualify for a much larger mortgage amount than you would with a traditional “A” lender program.

Learn More >>

Why Work With a Self-Employed Mortgage Specialist

- Focused on self-employed mortgages

- Clear guidance to avoid unnecessary declines

- Access to Lenders That Support Self-Employed Borrowers

- Faster, Smoother Mortgage Approvals

Owen Langis with Mortgage Connection

Passion for helping business owners.

Owen Langis with Mortgage Connection is a mortgage broker who is focused on self-employed mortgages & is passionate about helping Calgary business owners secure the mortgage financing they deserve.

With experience in traditional and alternative self-employed lending programs, Owen understands the challenges entrepreneurs face when qualifying for a mortgage with traditional banks.

He takes the time to listen, simplify the process, and build mortgage solutions that reflect your real financial strength — not just your taxable income.

If you’re a Calgary business owner looking for a mortgage expert who is focused on self-employed mortgages and truly understands your world, Owen is here to help you every step of the way.

Areas We Serve Around Calgary

Airdrie | Okotoks | High River | Langdon | Cochrane | Chestermere

💡 Did you know?

We work with Big Banks, Credit Unions and other mortgage lenders who specialize in self-employed mortgages.

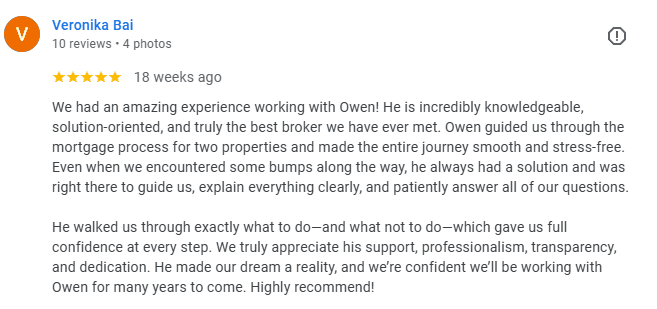

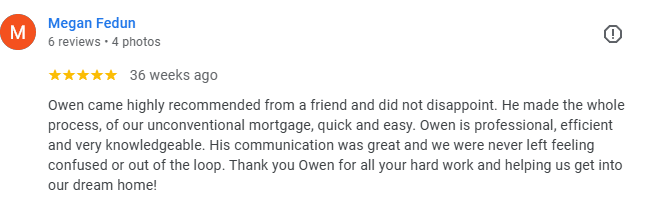

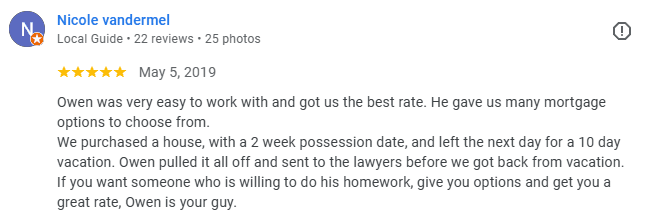

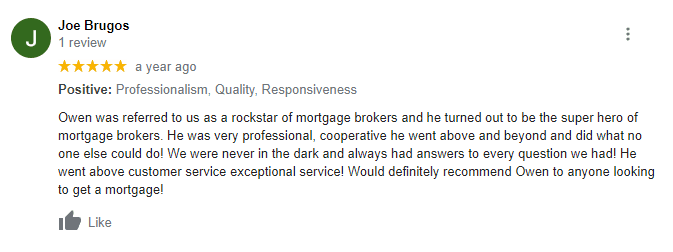

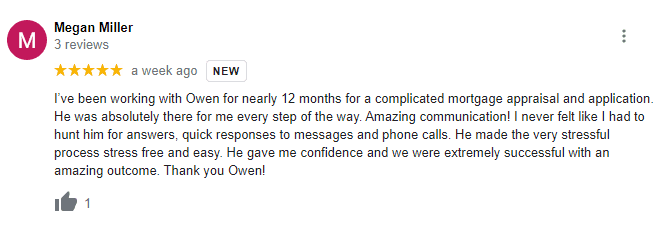

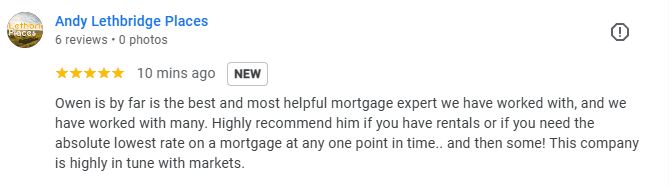

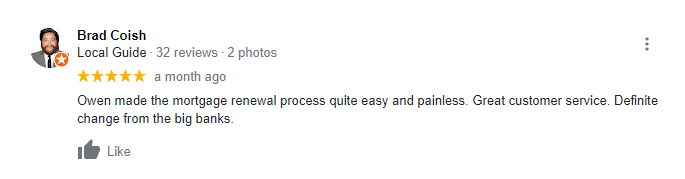

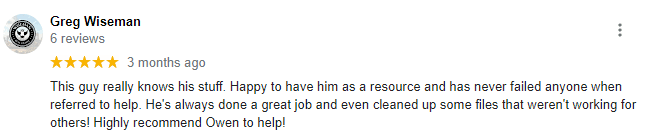

Trusted By Calgary Business Owners

💡 Did you know?

Did you know we may be able to get your mortgage application approved with another lender.

Self-Employed Mortgage FAQs (Calgary)

Can I qualify for a mortgage with less than two years of self-employment?

Absolutely — many business owners in Calgary qualify for a mortgage even with less than two years in business. Lenders look at your overall financial picture, not just your tax returns, and there are flexible mortgage programs designed specifically for new business owners. If you’re in this situation, I’d be happy to walk you through your options and help you see exactly what you can qualify for.

What documents do lenders need if I don’t have two full years of tax returns?

Lenders can still review your application without two full years of personal self-employed tax returns — they will look at other documents to understand your income and business stability. This may include your last 2 years T4s demonstrating previous industry experience, business bank statements, invoices or contracts, financial statements, NOAs and a detailed overview of your business. Every lender is a little different. I can help you figure out exactly what you need and make the process quick and stress-free.

How do mortgage lenders calculate my income when my business is new?

When your business is new, lenders often use more flexible methods to understand your true earning power. Instead of relying only on tax returns, they may look at your historical income based on your industry experience, business deposits, contracts and sales history. This helps paint a clearer picture of how your business is actually performing.

Do I need a larger down payment because I’m newly self-employed?

Not necessarily — many new business owners in Calgary still qualify with as little as 5% down. Some lenders may offer more flexibility than others if you have strong credit and solid industry experience. A larger down payment can help in certain cases, but it isn’t required for everyone. If you’re unsure where you stand, I’d be happy to take a look and show you exactly what options are available to you.

Which lenders offer the best mortgage programs for new business owners?

Several lenders offer great mortgage programs specifically designed for new business owners — The best lender fit depends on your credit, down payment, and previous industry experience. It is important to remenber that not all lenders offer mortgage programs for new business owners. If you have been declined at your bank, please feel free to contact us for additional mortgage options.

💡 Did you know?

Did you know we help Incorporated, sole proprietor & contract business owners.

Get Self-Employed Mortgage Advice Today

Book a call

Feel free to book a call at a time that works best with your busy schedule

owen@mortgageconnection.ca

Send us a message via email

(403) 968-8512

Feel free to give us a call

Do you have questions?

Let’s chat.